In the ever-evolving landscape of the cryptocurrency industry, asset security remains a paramount concern. Whether you are an individual dabbling in crypto trading or a business amassing a digital treasury, safeguarding your assets is crucial. Multi-signature wallets, especially on networks like Hedera, offer an advanced, yet flexible, approach to asset security. In this blog, we will explore the intricacies of multi-signature wallets, their types, real-world applications, and how they are uniquely positioned to secure assets on the Hedera Network,

What are Multi-Signature Wallets?

A multi-signature wallet is a type of digital wallet that require multiple signatures, or private keys, to authorise transactions. This is a departure from standard, single-keypair wallets where one private key can unlock the funds. The multi-signature setup adds an essential layer of complexity, thereby reducing the vulnerability associated with relying on a single point of failure.

Compared to simple keypairs, multi-signature wallets provide range of benefits like an extra layer of security and enhanced trust. It gives you the option of storing your keys across different formats and locations.

This technology allows users to designate how many signatures are required, offering a dynamic and adaptable security solution.

Why Multi-Signature Wallets Matter

Multi-signature wallets offer far more than just an extra layer of security. They can be used to introduce the concept of ‘consensus’ into financial transactions. In a business setup, for instance, this can be invaluable. Decisions about large fund transfers could require the agreement of multiple parties, ensuring that no single individual can unilaterally make significant financial decisions. This shared control enhances trust among stakeholders and adds an additional audit layer, making financial oversight more transparent and accountable.

The Different Types of Complex Keys on Hedera

Simple Multi-Signature wallets are just one type of complex key structure in the world of cryptocurrency. Other types include:

- Threshold Multi-Signatures

- Nested Signatures

Threshold Multi-Signatures

This type allows flexibility in authorisation. Instead of requiring all keys for a transaction, you can set a threshold. For example, if an account has five keypairs, you could configure it so that any three keys can authorise a single transaction.

One of the primary benefits of using a threshold for multi-signature accounts is the added security for your assets. In the given example, where you create an account with 5 keypairs and set a threshold of 3 accounts, you could lose 2 keypairs and still have access to your funds. This is great for people or instituions who want to mitigate the risk of keyloss by storing their keys across several locations and haing redundancy built in to cover any loss of keys.

Nested Signatures

This advanced structure allows for a multi-tiered authorisation system. It combines simple keypairs, multi-sigs, and thresholds to create a complex, yet highly secure, system. Businesses can set up multiple tiers of employees, each with different private keys and authorisation levels, thus maintaining a granular level of control.

On the other hand, a Nested Multi-Signature account allows you to combine simple keypairs, multi-sigs, and threshold signatures all together.

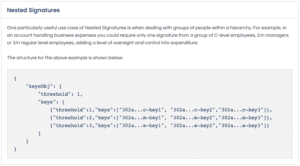

Looking at example below you can have 3 different groups of people within a company that each group consists of 3 different people holding private keys. You can set the threshold of requiring only one signature from a group of C-level employees (c-key), while also requiring 2 out of 3 signatures from managers (m-key) and 3 signatures from regular level employees (e-key). Setting threshold 1 of that nested group would mean that you need only 1 group to execute any transaction

Nested Signature code structure used to create an account with Yamgo

The way user manages it is up to him/her and the user can setup any threshold and number of groups he/she is happy with.

Real-Life Use Cases for Multi-Signature Wallets

There are many real-life scenarios in which multi-signature wallets can be useful.

Multi-signature accounts can benefit a wide range of individuals and organizations.

These could include but are not limited to:

- Crypto Investors: Individual and institutional investors can add an extra layer of security, thereby protecting their substantial investments from potential threats.

- DAOs: Decentralised Autonomous Organisations can implement multi-sig wallets to ensure that decision-making is democratic and transparent.

- Crypto exchanges or marketplaces

- Cryptocurrency projects and organisations

- Business Partnerships: In a joint business account, multi-signature technology ensures that all major transactions require collective approval, effectively reducing the likelihood of fraud or mismanagement.

Individuals can utilize multi-sig accounts to ensure that their cryptocurrency can be accessed not only by themselves but also by others (e.g., family members), but only with the involvement of several key holders. This approach helps individuals mitigate issues associated with being the sole key holder, such as the risk of loss or becoming a target.

Crypto exchanges can implement a requirement for multiple signatures to approve withdrawals or transfers of user funds, thereby reducing the risk of funds being stolen or misused.

Real estate companies can employ multi-sig accounts to manage escrow transactions, guaranteeing that all involved parties must provide their approval before funds are released.

Non-profit organizations can utilize multi-sig accounts to ensure that all donations and expenses undergo approval from multiple parties.

A joint account between business partners can use multi-sig accounts to ensure that all financial transactions require the approval of all parties involved. Reducing the risk of fraud or mismanagement.

Multi-Signatures on Hedera

Yamgo is currently the only platform on the Hedera network that supports complex key structures (multi-signature accounts). Yamgo is an ultra-secure unhosted cold wallet with gamification features on top. It supports Ledger account creation and staking, multi signature accounts and simple standard wallets. To find out more about Yamgo you can find more information on our website

You can find more details on these complex key types in the official Hedera documentation here.

The Hedera Network and platforms like Yamgo are making strides in the realm of digital asset security through multi-signature wallets. While they are an instrumental part of a holistic security strategy. In summary if you’re looking to protect your digital assets on the Hedera network, a multi-signature wallet is an excellent choice.

With its customizable signature requirements, multi-signature wallets provide businesses and individuals with an added layer of security that can help safeguard funds from cyber threats. However, it’s important to remember that they are not foolproof. Users should utilize them in conjunction with other best practices, such as employing strong passwords and implementing two-factor authentication.

What is your view on multi-signature accounts? Have you ever used one of these methods? Do you think they are more secure? Let me know down in the comments!